- The paper introduces FinCon, a synthesized LLM multi-agent system that enhances financial decision-making using a hierarchical manager-analyst framework.

- It employs CVaR-based within-episode controls and CVRF-driven over-episode updates to optimize short-term trading strategies and long-term portfolio performance.

- Experimental results demonstrate FinCon’s superior cumulative returns and Sharpe Ratios compared to traditional and other AI-driven financial strategies.

FinCon: A Synthesized LLM Multi-Agent System for Financial Decision Making

The paper introduces FinCon, a multi-agent framework utilizing LLMs to enhance financial decision-making by incorporating conceptual verbal reinforcement. FinCon excels in tasks like single stock trading and portfolio management by employing a sophisticated architecture inspired by investment firms' hierarchies.

Framework and Architecture

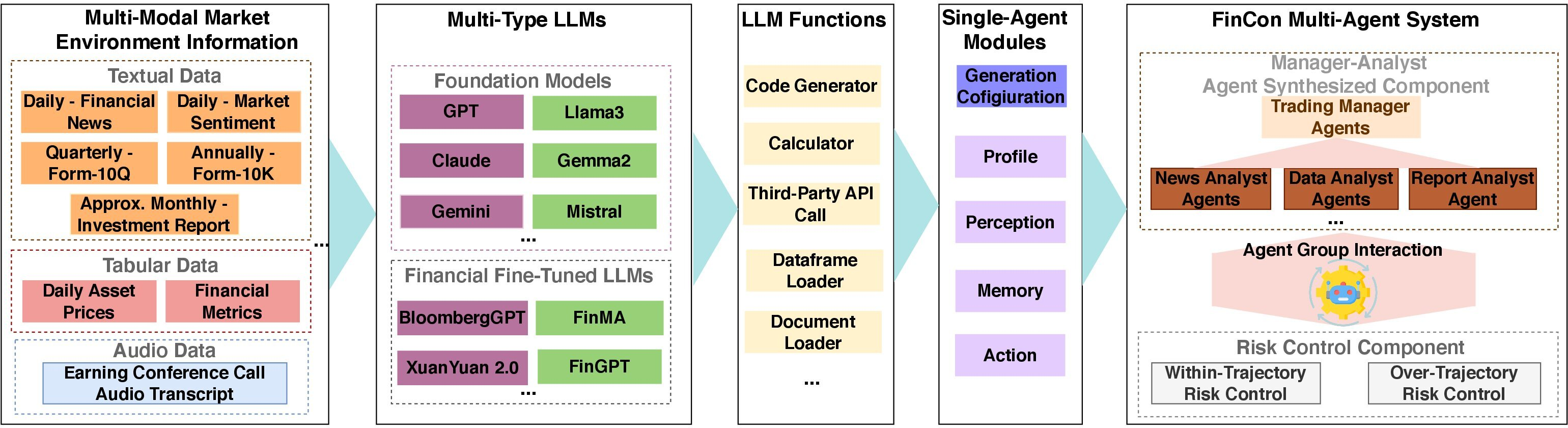

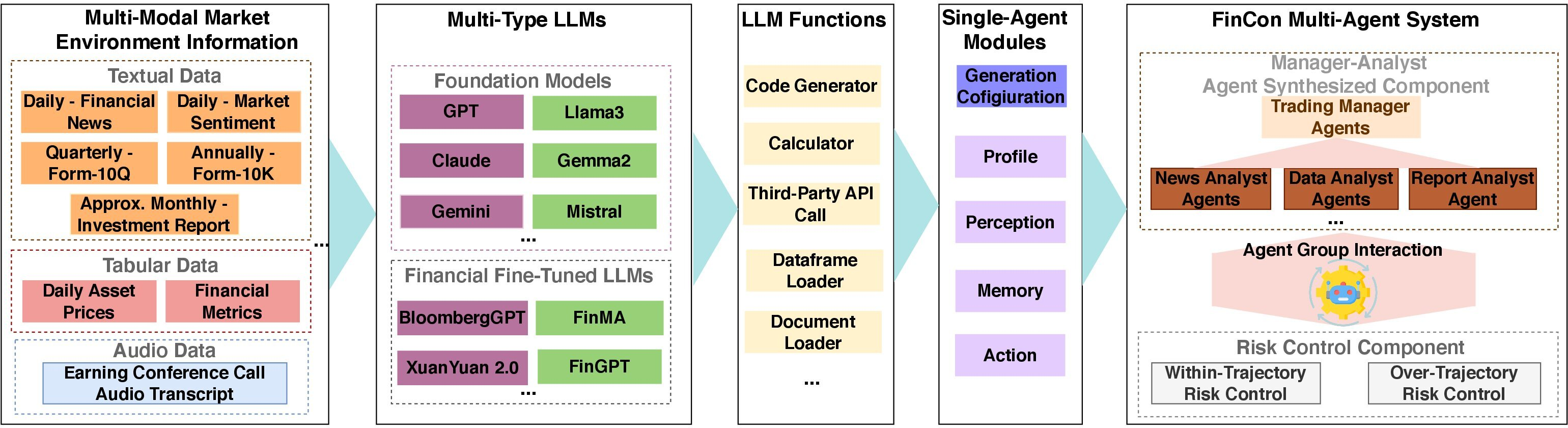

FinCon is structured to mirror the teamwork found in real-world investment firms, featuring a hierarchy of manager and analyst agents. The framework enables effective collaboration across agents through coordinated interpretation of financial data and dynamic risk management.

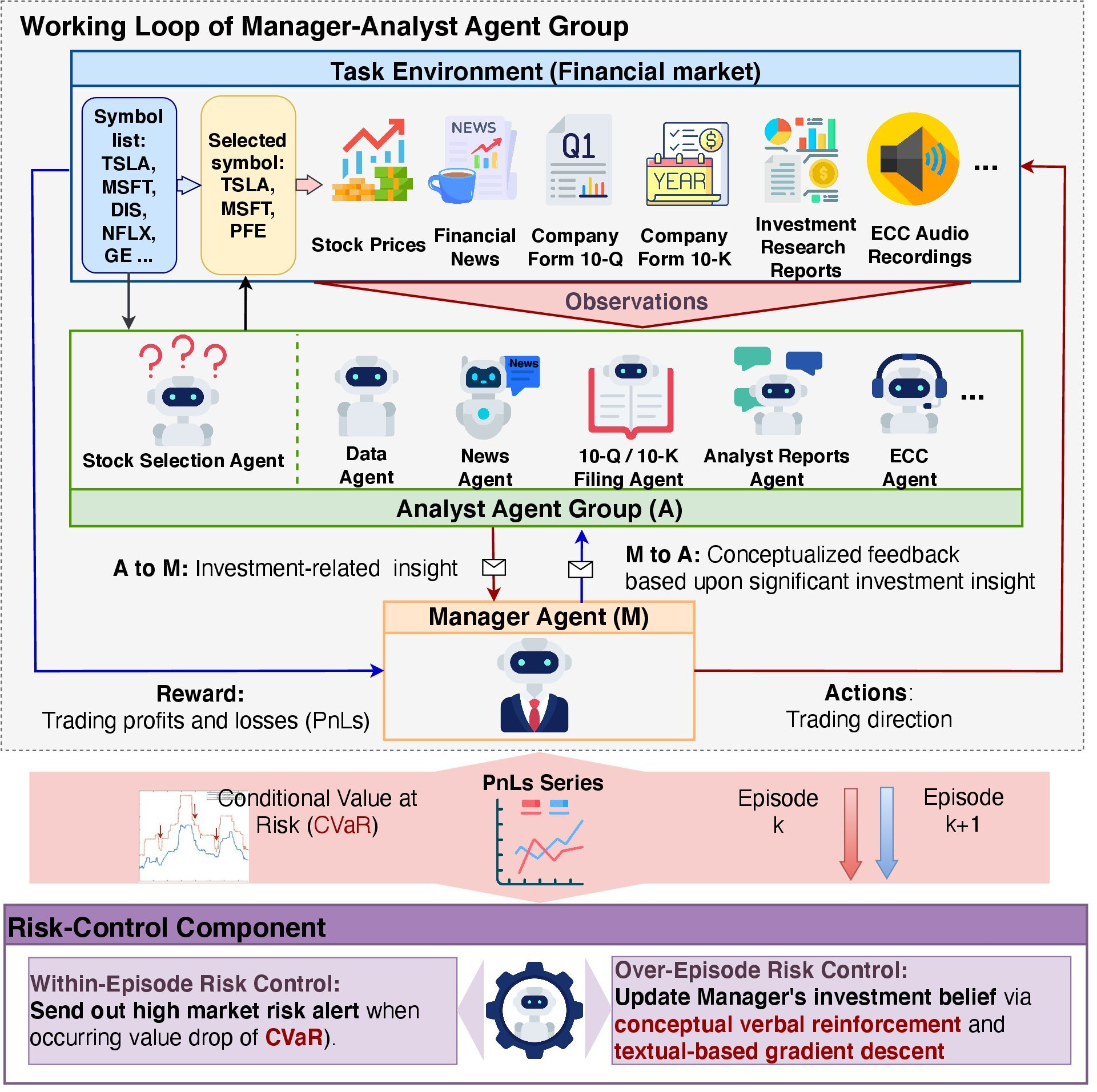

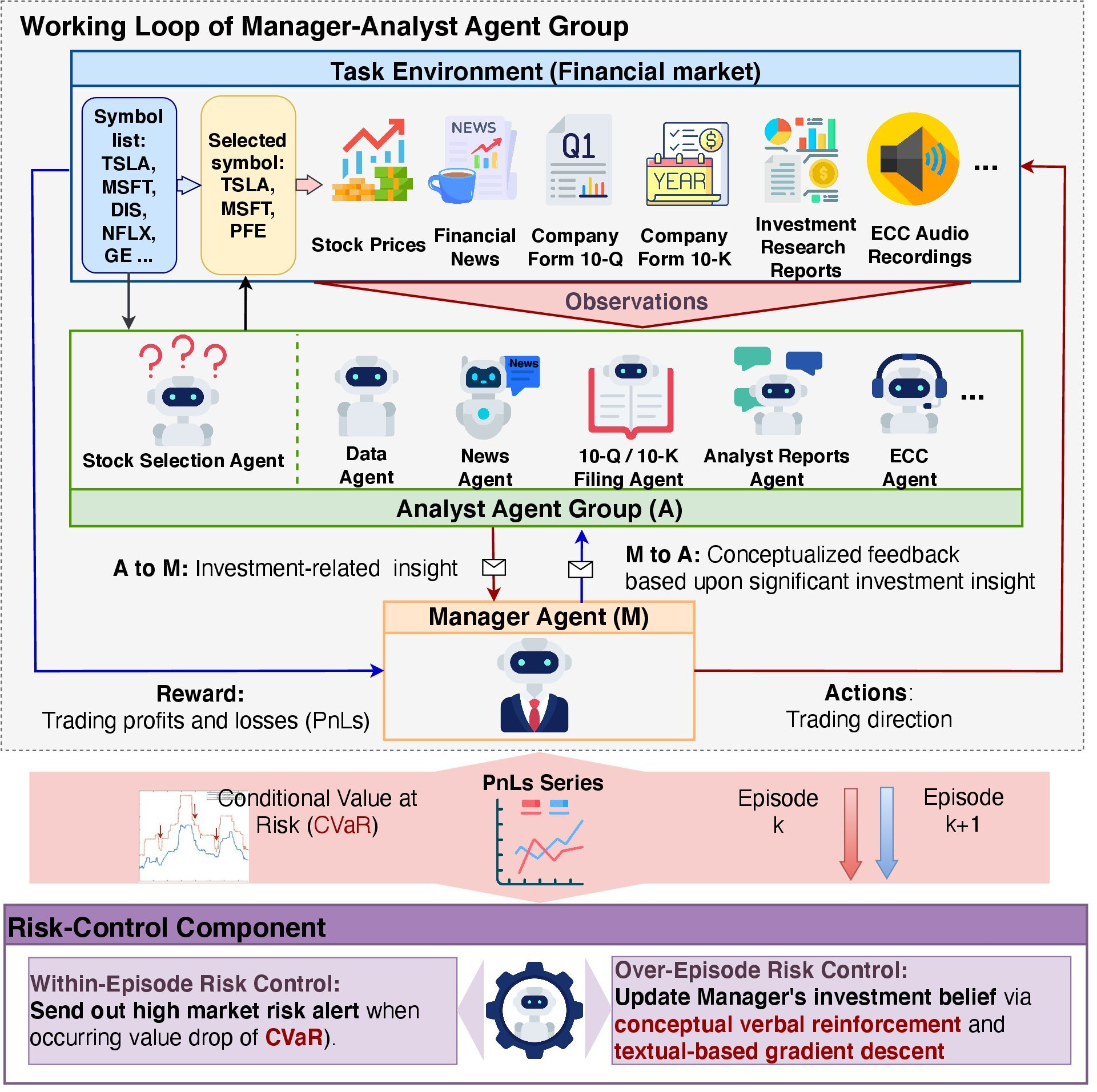

Manager-Analyst Hierarchy

The architecture of FinCon is built around a Manager-Analyst paradigm where the Manager integrates insights from specialized Analyst agents who process distinct forms of financial data such as news articles, earnings call audio, and financial statements. This division of labor allows for a comprehensive understanding of market conditions while minimizing redundant communication overhead.

Figure 1: The general framework of FinCon.

This structure is operationalized by enabling textual exchanges among agents to streamline decision-making. By channeling valuable insights through a structured hierarchy, FinCon aims to maximize investment returns while managing risk exposure effectively.

Dual-Level Risk Control

Risk management in FinCon is divided into two levels: within-episode and over-episode. The within-episode mechanism employs Conditional Value at Risk (CVaR) to assess short-term risks, allowing the Manager to adjust trading strategies in real time based on market volatility. Over-episode risk control uses Conceptual Verbal Reinforcement (CVRF) to update long-term investment beliefs based on episodic reflections, guiding agents towards more profitable strategies.

Figure 2: The detailed architecture of FinCon contains two key components: Manager-Analyst agent group and Risk Control. It also presents the interaction of FinCon and decision-making flow.

FinCon demonstrates superior performance across multiple financial decision-making scenarios, particularly in single stock trading and portfolio management. It consistently outperforms traditional strategies and other AI-driven systems in metrics such as Cumulative Returns and Sharpe Ratios, showcasing its robustness in various market conditions.

Single Asset Trading

In single asset trading tasks, FinCon leads in achieving higher cumulative returns and better risk-adjusted returns compared to both LLM-based and DRL-based systems. The results highlight its ability to synthesize diverse market data effectively.

Portfolio Management

For portfolio management, FinCon's architecture generalizes beyond single assets, successfully optimizing multi-asset portfolios. Its dual-level risk controls contribute significantly to managing volatility, as demonstrated by improved metrics across all tested portfolios.

Figure 3: Portfolio values of Portfolio 1 and 2 changes over time for all the strategies.

Ablation Studies

Ablation studies confirm that both the CVaR-based within-episode controls and CVRF-based over-episode belief updates contribute significantly to FinCon's performance. Removing these features led to noticeable declines in trading efficiency and returns, underscoring their importance.

(Figure 4), (Figure 5)

Figure 4: CRs over time for single-asset trading tasks; FinCon outperformed other strategies.

Figure 5: CRs with vs. without implementing CVaR; the CVaR mechanism significantly improves FinCon's performance.

Conclusion

FinCon exemplifies a groundbreaking approach to integrating advanced LLMs within a multi-agent system tailored for financial decision-making. Its hierarchical structure, coupled with innovative risk control mechanisms, enhances both decision quality and efficiency. Future work could explore scaling FinCon's capabilities to manage larger portfolios involving sophisticated risk management requirements, continuing to refine its interaction of agent-based learning and financial acumen.