- The paper introduces monetized arbitrage profit and shows that MaxMax and Convex Optimization strategies outperform the traditional MaxPrice method.

- It employs both synthetic examples and Uniswap V2 data to validate improved profit calculations by integrating token prices from centralized exchanges.

- The Convex Optimization strategy theoretically guarantees at least equal profits to MaxMax, though its higher computational demand may affect real-world applications.

Profit Maximization in Arbitrage Loops

Introduction

The paper "Profit Maximization In Arbitrage Loops" tackles the problem of optimizing arbitrage profits in decentralized exchanges (DEXs), specifically focusing on cyclic arbitrage mechanisms. By considering token prices from centralized exchanges (CEXs), the authors redefine traditional arbitrage profit as "monetized arbitrage profit." This concept leads to the introduction of three distinct strategies aimed at maximizing these profits within arbitrage loops: the MaxPrice strategy, the MaxMax strategy, and the Convex Optimization strategy. Each strategy proposes a different approach to profit calculation, with the Convex Optimization strategy anticipated to outperform others theoretically.

Arbitrage Strategies

MaxPrice Strategy

The MaxPrice strategy applies a simplistic approach by initiating arbitrage from tokens with the highest CEX prices. This strategy reflects common beliefs that starting arbitrage with higher-valued tokens yields better profits. However, empirical findings in the paper indicate that this approach is not consistently reliable for maximizing monetized arbitrage profit, demonstrating limitations in real-world applications.

MaxMax Strategy

Designed to overcome the deficiencies of the MaxPrice strategy, the MaxMax strategy evaluates arbitrage profits for each token in a loop and selects the highest outcome. Mathematically proving to yield better results than MaxPrice, this strategy is shown to consistently provide better monetized arbitrage profits.

Figure 1: Monetized arbitrage profit by starting from different ways tokens and by the MaxMax strategy with token X's price from CEX (Px) changing. The red dot line denotes the monetized arbitrage profit from the MaxMax strategy, and the other three lines denote the monetized arbitrage profits from three different ways of arbitrage.

Convex Optimization Strategy

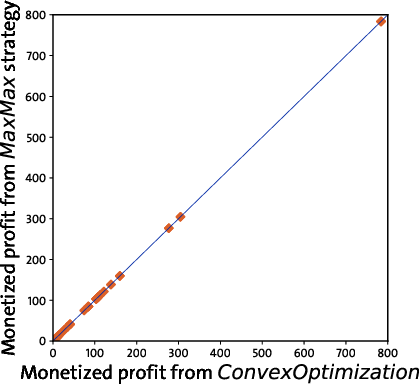

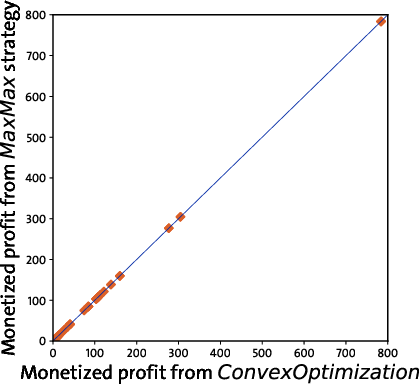

The Convex Optimization strategy, mapping the MaxMax strategy into a convex optimization problem, theoretically guarantees superior profits. The approach ensures that profit is at least as great as what is achieved by MaxMax. Empirically, however, the findings show that while optimization introduces complexity, the profitability differs insignificantly between these strategies.

Figure 2: Monetized arbitrage profit by the Convex Optimization strategy and the MaxMax strategy with token X's price from CEX (Px) changing. Arbitrageurs can always get more or at least equal profits by taking the Convex Optimization strategy compared to the MaxMax strategy.

Comparative Analysis

The paper compares these strategies using both synthetic examples and real-world data from Uniswap V2 as of September 2023. It demonstrates that while the MaxMax and Convex Optimization strategies closely match in terms of profitability, the latter is computationally demanding.

Figure 3: Monetized arbitrage profit from the MaxMax strategy vs that from traditional arbitrage strategies. The x-axis of each scatter plot is the monetized arbitrage profit from the MaxMax strategy, and the y-axis denotes the monetized arbitrage profit from a traditional arbitrage strategy.

Figure 4: Monetized arbitrage profit from the Convex Optimization strategy vs that from the MaxMax strategy. The x-axis of each scatter plot is the monetized arbitrage profit from the Convex Optimization strategy and the y-axis denotes the monetized arbitrage profit from the MaxMax strategy.

Implications and Future Directions

This research highlights key considerations in leveraging arbitrage opportunities on DEXs by acknowledging token values from CEXs, refining profit calculations, and introducing strategies that improve monetized arbitrage outcomes. While theoretically robust, the Convex Optimization strategy's practical constraints suggest potential areas for future research, including reducing computational overhead and improving real-time application feasibility.

Conclusion

The findings in the paper establish that the MaxMax and Convex Optimization strategies outperform traditional and MaxPrice strategies in maximizing monetized arbitrage profits. Future advancements may focus on optimizing computational efficiency and providing more adaptable solutions for rapidly changing market conditions.