Transparency and Privacy: The Role of Explainable AI and Federated Learning in Financial Fraud Detection (2312.13334v1)

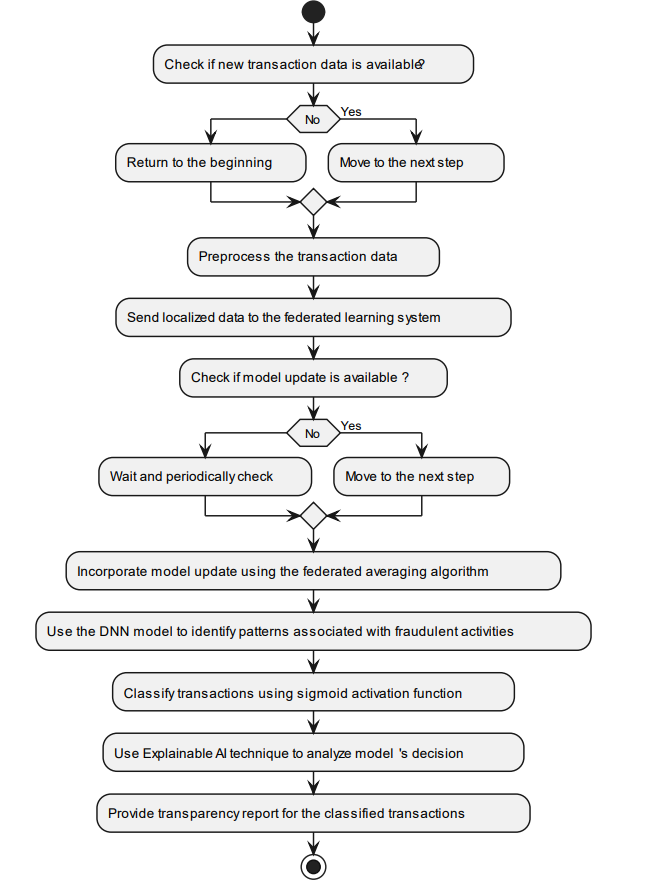

Abstract: Fraudulent transactions and how to detect them remain a significant problem for financial institutions around the world. The need for advanced fraud detection systems to safeguard assets and maintain customer trust is paramount for financial institutions, but some factors make the development of effective and efficient fraud detection systems a challenge. One of such factors is the fact that fraudulent transactions are rare and that many transaction datasets are imbalanced; that is, there are fewer significant samples of fraudulent transactions than legitimate ones. This data imbalance can affect the performance or reliability of the fraud detection model. Moreover, due to the data privacy laws that all financial institutions are subject to follow, sharing customer data to facilitate a higher-performing centralized model is impossible. Furthermore, the fraud detection technique should be transparent so that it does not affect the user experience. Hence, this research introduces a novel approach using Federated Learning (FL) and Explainable AI (XAI) to address these challenges. FL enables financial institutions to collaboratively train a model to detect fraudulent transactions without directly sharing customer data, thereby preserving data privacy and confidentiality. Meanwhile, the integration of XAI ensures that the predictions made by the model can be understood and interpreted by human experts, adding a layer of transparency and trust to the system. Experimental results, based on realistic transaction datasets, reveal that the FL-based fraud detection system consistently demonstrates high performance metrics. This study grounds FL's potential as an effective and privacy-preserving tool in the fight against fraud.

- UKFinance, “Annual fraud report 2022,” https://www.ukfinance.org.uk/policy-and-guidance/reports-and-publications/annual-fraud-report-2022, 2022.

- A. Abdallah, M. A. Maarof, and A. Zainal, “Fraud detection system: A survey,” Journal of Network and Computer Applications, vol. 68, pp. 90–113, 2016.

- A. Pascual, K. Marchini, S. Miller, and J. S. . Research., “2017 identity fraud: securing the connected life,” Javelin (February 1), http://www. javelinstrategy. com/coverage-area/2017-identity-fraud, 2017.

- S. Bhattacharyya, S. Jha, K. Tharakunnel, and J. C. Westland, “Data mining for credit card fraud: A comparative study,” Decision support systems, vol. 50, no. 3, pp. 602–613, 2011.

- L. T. Rajesh, T. Das, R. M. Shukla, and S. Sengupta, “Give and take: Federated transfer learning for industrial iot network intrusion detection,” 2023.

- S. Vyas, A. N. Patra, and R. M. Shukla, “Histopathological image classification and vulnerability analysis using federated learning,” 2023.

- R. J. Bolton and D. J. Hand, “Statistical fraud detection: A review,” Statistical science, vol. 17, no. 3, pp. 235–255, 2002.

- H. Van Driel, “Financial fraud, scandals, and regulation: A conceptual framework and literature review,” Business History, 2018.

- G. M. Trompeter, T. D. Carpenter, N. Desai, K. L. Jones, and R. A. Riley, “A synthesis of fraud-related research,” Auditing: A Journal of Practice & Theory, vol. 32, no. Supplement 1, pp. 287–321, 2013.

- P. Raghavan and N. El Gayar, “Fraud detection using machine learning and deep learning,” in 2019 international conference on computational intelligence and knowledge economy (ICCIKE). IEEE, 2019, pp. 334–339.

- M. Zareapoor, P. Shamsolmoali et al., “Application of credit card fraud detection: Based on bagging ensemble classifier,” Procedia computer science, vol. 48, no. 2015, pp. 679–685, 2015.

- K. Randhawa, C. K. Loo, M. Seera, C. P. Lim, and A. K. Nandi, “Credit card fraud detection using adaboost and majority voting,” IEEE access, vol. 6, pp. 14 277–14 284, 2018.

- Sharma, M. Abhilash, Raj, B. R. Ganesh, Ramamurthy, B., and Bhaskar, R. Hari, “Credit card fraud detection using deep learning based on auto-encoder,” ITM Web Conf., vol. 50, p. 01001, 2022. [Online]. Available: https://doi.org/10.1051/itmconf/20225001001

- A. Pumsirirat and Y. Liu, “Credit card fraud detection using deep learning based on auto-encoder and restricted boltzmann machine,” International Journal of advanced computer science and applications, vol. 9, no. 1, 2018.

- S. Kamei and S. Taghipour, “A comparison study of centralized and decentralized federated learning approaches utilizing the transformer architecture for estimating remaining useful life,” Reliability Engineering & System Safety, vol. 233, p. 109130, 2023.

- B. McMahan, E. Moore, D. Ramage, S. Hampson, and B. A. y Arcas, “Communication-efficient learning of deep networks from decentralized data,” in Artificial intelligence and statistics. PMLR, 2017, pp. 1273–1282.

- I. Benchaji, S. Douzi, and B. El Ouahidi, “Credit card fraud detection model based on lstm recurrent neural networks,” Journal of Advances in Information Technology, vol. 12, no. 2, 2021.

- S. Bharati, M. Mondal, P. Podder, and V. Prasath, “Federated learning: Applications, challenges and future directions,” International Journal of Hybrid Intelligent Systems, vol. 18, no. 1-2, pp. 19–35, 2022.

- W. Yang, Y. Zhang, K. Ye, L. Li, and C.-Z. Xu, “Ffd: A federated learning based method for credit card fraud detection,” in Big Data–BigData 2019: 8th International Congress, Held as Part of the Services Conference Federation, SCF 2019, San Diego, CA, USA, June 25–30, 2019, Proceedings 8. Springer, 2019, pp. 18–32.

- F. Doshi-Velez and B. Kim, “Towards a rigorous science of interpretable machine learning,” arXiv preprint arXiv:1702.08608, 2017.

- K. Bonawitz, H. Eichner, W. Grieskamp, D. Huba, A. Ingerman, V. Ivanov, C. Kiddon, J. Konečnỳ, S. Mazzocchi, B. McMahan et al., “Towards federated learning at scale: System design,” Proceedings of machine learning and systems, vol. 1, pp. 374–388, 2019.

- Q. Yang, Y. Liu, T. Chen, and Y. Tong, “Federated machine learning: Concept and applications,” ACM Transactions on Intelligent Systems and Technology (TIST), vol. 10, no. 2, pp. 1–19, 2019.

- S. M. Lundberg and S.-I. Lee, “A unified approach to interpreting model predictions,” Advances in neural information processing systems, vol. 30, 2017.

- S. Jesus, J. Pombal, D. Alves, A. Cruz, P. Saleiro, R. P. Ribeiro, J. Gama, and P. Bizarro, “Turning the Tables: Biased, Imbalanced, Dynamic Tabular Datasets for ML Evaluation,” Advances in Neural Information Processing Systems, 2022.

- N. V. Chawla, K. W. Bowyer, L. O. Hall, and W. P. Kegelmeyer, “Smote: synthetic minority over-sampling technique,” Journal of artificial intelligence research, vol. 16, pp. 321–357, 2002.

- X. Wan, W. Wang, J. Liu, and T. Tong, “Estimating the sample mean and standard deviation from the sample size, median, range and/or interquartile range,” BMC medical research methodology, vol. 14, pp. 1–13, 2014.

- M. Hegland, “Data mining techniques,” Acta numerica, vol. 10, pp. 313–355, 2001.

Sponsor

Paper Prompts

Sign up for free to create and run prompts on this paper using GPT-5.

Top Community Prompts

Collections

Sign up for free to add this paper to one or more collections.