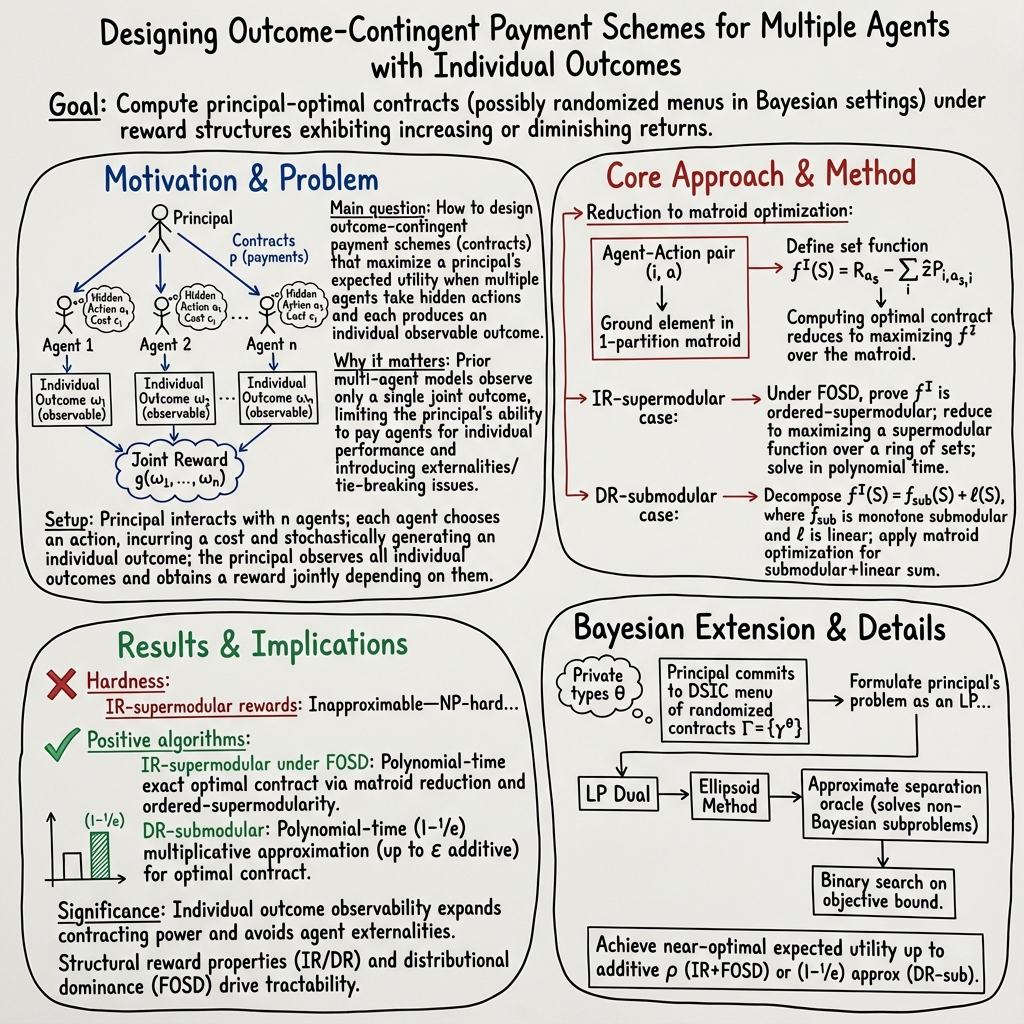

- The paper's main contribution is the formulation of a principal-multi-agent model where contracts depend on individually observed outcomes.

- It shows that optimal contracts for IR-supermodular rewards can be computed in polynomial time, while DR-submodular rewards admit a (1-1/e) approximation algorithm.

- The study extends to Bayesian settings by approximating menus of randomized contracts through linear programming and the ellipsoid method.

Multi-Agent Contract Design with Individual Outcomes

This paper (2301.13654) investigates hidden-action principal-agent problems involving multiple agents, where each agent's action leads to an individual outcome observed by the principal. The principal aims to incentivize agents through contracts, which are outcome-dependent payment schemes. The work analyzes the computational complexity of finding principal-optimal contracts, introducing properties of the principal's rewards called IR-supermodularity and DR-submodularity.

Core Contributions

The authors focus on scenarios where the principal observes each agent's individual outcome, enhancing the principal's ability to tailor payments based on individual results. The key contributions are:

- Model Formulation: Introduction of a principal-multi-agent problem where each agent's action determines their individual outcome, and the principal observes all outcomes separately.

- Reward Properties: Analysis of IR-supermodularity (increasing returns) and DR-submodularity (diminishing returns) in the context of principal's rewards.

- Complexity Analysis: Examination of the computational complexity of finding optimal contracts under these reward properties, both in non-Bayesian and Bayesian settings.

- Approximation Algorithms: Development of polynomial-time approximation algorithms for DR-submodular rewards, and polynomial-time exact algorithms for IR-supermodular rewards under certain regularity conditions.

- Bayesian Extension: Extension of the model to Bayesian settings where agents have private types, and provision of an approximation algorithm for computing optimal menus of randomized contracts.

Technical Approach

The paper employs several techniques to address the problem:

- Matroid Reduction: Reduction of the problem of finding an optimal contract to a maximization problem over a specially-defined matroid.

- Ordered-Supermodularity: Introduction of ordered-supermodular functions and a polynomial-time algorithm for maximizing these functions over $1$-partition matroids.

- First-Order Stochastic Dominance (FOSD): Exploitation of FOSD conditions to design polynomial-time algorithms for instances with IR-supermodular rewards.

- Submodularity and Approximation: Use of submodularity properties and results from Sviridenko et al. to develop polynomial-time approximation algorithms for DR-submodular rewards.

- Linear Programming and Ellipsoid Method: Formulation of the Bayesian problem as a linear program and use of the ellipsoid method with an approximate separation oracle to derive approximation algorithms.

Key Definitions and Assumptions

The paper relies on the following key definitions and assumptions:

- IR-supermodularity: Rewards grow faster as agents' effort increases.

- DR-submodularity: Rewards grow slower as effort increases.

- Succinct Rewards: Principal's rewards are represented by a reward function g that depends on a low-dimensional vector of outcomes.

- Increasing Rewards: The principal's reward function is increasing with respect to each agent's outcome.

- Null Action: Existence of a zero-cost action that provides a non-negative utility to the agent.

- First-Order Stochastic Dominance (FOSD): Higher-cost actions induce probability distributions that stochastically dominate those induced by lower-cost actions.

- Null outcome: There exists an outcome with a vector of zeros, which occurs when the agent takes the null action

Non-Bayesian Setting: Inapproximability and Approximation

The authors prove that finding an optimal contract is NP-hard, even with fixed numbers of actions and outcomes, both for IR-supermodular and DR-submodular rewards. To circumvent this, they introduce a regularity assumption, FOSD, and show that an optimal contract can be found in polynomial time for IR-supermodular rewards. For DR-submodular rewards, they provide a polynomial-time approximation algorithm that achieves a (1−1/e) multiplicative approximation, up to a small additive loss.

Bayesian Setting: Menus of Randomized Contracts

The paper extends the model to a Bayesian setting where each agent has a private type. It is shown that the principal benefits from committing to a menu of randomized contracts. The authors provide a characterization of the principal's optimization problem, showing that it can be approximately solved by means of a linear program. Based on this, they design a polynomial-time approximation algorithm using an ad hoc implementation of the ellipsoid method, achieving approximation guarantees similar to the non-Bayesian setting.

Implications and Future Directions

The research provides insights into the design of optimal contracts in multi-agent settings with individual outcomes. The computational complexity results and approximation algorithms offer guidance for practical applications.

Possible future research directions include:

- Exploring other properties of principal's rewards beyond IR-supermodularity and DR-submodularity.

- Investigating alternative approximation techniques for settings where the FOSD condition is not satisfied.

- Studying the impact of different tie-breaking rules on the complexity of contract design.

- Extending the model to dynamic settings where the principal interacts with agents over multiple periods.

Conclusion

This paper (2301.13654) offers a comprehensive analysis of multi-agent contract design with individual outcomes. By introducing relevant properties of the principal's rewards and leveraging techniques from algorithmic game theory and combinatorial optimization, the authors provide valuable insights into the computational aspects of this problem, along with practical algorithms.