- The paper introduces a novel hybrid GARCH-LSTM-DCC model integrating GARCH parameters with LSTM networks to forecast asset return covariances.

- It leverages one-hot encoding and ex-post volatility estimators, achieving improved risk performance in minimum variance portfolio frameworks.

- Empirical results show that combining econometric and deep learning techniques enhances forecast accuracy in high-dimensional financial data.

Hybrid GARCH-LSTMs for Forecasting Covariance Matrices

The paper "Forecasting High-Dimensional Covariance Matrices of Asset Returns with Hybrid GARCH-LSTMs" (2109.01044) introduces a novel approach to forecasting covariance matrices of asset returns by integrating univariate GARCH models with LSTM neural networks in a multivariate setting. This hybrid model aims to leverage the strengths of both econometric and machine learning techniques to improve the accuracy of covariance matrix forecasts, particularly in high-dimensional settings. The paper investigates whether incorporating GARCH parameters as inputs into LSTM networks can enhance the performance of traditional multivariate GARCH models, such as the DCC model, in a minimum variance portfolio framework.

Background and Motivation

Accurate forecasting of asset return volatility and covariances is crucial for various financial applications, including portfolio optimization and risk management. While GARCH-type models have been widely used for volatility forecasting, their extension to high-dimensional settings poses challenges due to the "curse of dimensionality." The DCC model, introduced by \textcite{DCC}, offers a practical solution by modeling conditional variances and correlations separately. However, the paper posits that further improvements can be achieved by integrating neural networks, particularly LSTMs, which have demonstrated proficiency in capturing both short-term and long-term dependencies in time series data.

The rationale behind hybrid GARCH-LSTM models is that LSTMs can effectively process diverse inputs and extract salient features for improved predictions. By incorporating GARCH parameters, which encapsulate valuable information about the conditional volatility process, the LSTM network can potentially learn more accurate volatility dynamics. This approach builds on previous research that has shown the benefits of hybrid GARCH-ANN models in univariate volatility forecasting.

Model Description

The paper proposes a new hybrid model called the GARCH-LSTM-DCC, which combines volatility forecasts from GARCH-LSTMs with correlation predictions from a DCC model. The GARCH-LSTM component utilizes an LSTM network to forecast the conditional volatilities of individual assets, incorporating GARCH(1,1) parameters as inputs.

The GARCH-LSTM-DCC model is constructed as follows:

- GARCH Parameter Estimation: Univariate GARCH(1,1) models are fitted to the training data for each asset to extract the GARCH parameters (α and β) and conditional volatilities (σt2).

- Ex-Post Volatility Estimation: Ex-post estimators of asset return daily volatility are computed for each asset.

- Hybrid Vector Construction: For each asset and time step, a hybrid vector Xi,t is created, consisting of the ex-post volatility estimator (di,t) and the GARCH(1,1) parameters (αiϵi,t2 and βiσi,t2). Thus, Xi,t=(di,t,αiϵi,t2,βiσi,t2)′.

- LSTM Training: The LSTM network is trained to predict the one-step-ahead conditional volatility using the past τ hybrid vectors as inputs. The training examples are defined as xi,k={Xi,t−τ,…,Xi,t−1} and yi,k=di,t.

- Covariance Matrix Forecasting: The out-of-sample forecast of the one-step-ahead conditional covariance matrix is computed as H^t=D^tR^tD^t, where D^t is a diagonal matrix with the volatility forecasts from the LSTM, and R^t is the conditional correlation matrix predicted by the DCC model.

To enhance the flexibility of the model, the paper also explores the use of one-hot encoding to differentiate between assets. This involves adding a binary vector to the input of the LSTM, indicating the specific asset being considered.

Implementation Details

The implementation of the GARCH-LSTM-DCC model involves several key steps:

- Data Preprocessing: The dataset consists of daily adjusted close prices for a sample of stocks. The data is preprocessed to calculate daily log returns and split the data into training and testing sets.

- GARCH Model Estimation: Univariate GARCH(1,1) models are estimated for each asset using the training data. The parameters (ω, α, β) and conditional volatilities are extracted for use as inputs to the LSTM network.

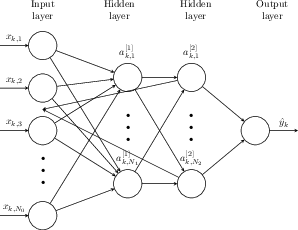

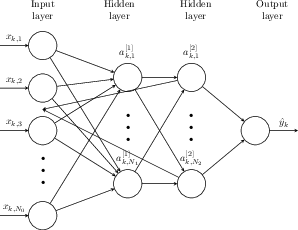

- LSTM Network Configuration:

- The LSTM network consists of an input layer, one or more LSTM layers, and one or more dense (feedforward) layers.

- The input layer receives the hybrid vectors containing GARCH parameters and lagged returns.

- The LSTM layers process the sequential input data and capture temporal dependencies.

- The dense layers map the LSTM outputs to the final volatility forecast.

- Activation functions, such as sigmoid or ReLU, are used in the LSTM and dense layers to introduce non-linearity.

- The network is trained using an appropriate loss function, such as mean squared error (MSE), and an optimization algorithm, such as Adam or RMSprop.

- DCC Model Estimation: The DCC model is estimated using the standardized residuals obtained from the GARCH models. This involves estimating the parameters of the DCC process, which govern the dynamics of the conditional correlation matrix.

- Covariance Matrix Forecasting: The conditional covariance matrix is forecast by combining the volatility forecasts from the LSTM network with the correlation forecasts from the DCC model.

Figure 1: Simple dense feedforward neural network with two hidden layers.

Empirical Evaluation

The performance of the GARCH-LSTM-DCC model is evaluated in a minimum variance portfolio framework using real-world stock data. The dataset comprises daily adjusted close prices of 400 stocks from the SP500 index between 2004 and 2020. The models are trained on a subset of the data and then used to construct minimum variance portfolios over an out-of-sample period.

The portfolios constructed and compared are:

- 1/N (Equally Weighted Portfolio)

- DCC (Multivariate GARCH)

- LSTM-DCC-OH (LSTM with One-Hot Encoding)

- G-LSTM-DCC-OH (GARCH-LSTM with One-Hot Encoding)

- LSTM-DCC (LSTM without One-Hot Encoding)

- G-LSTM-DCC (GARCH-LSTM without One-Hot Encoding)

The performance of the portfolios is assessed using annualized average return (AV), annualized standard deviation (SD), and information ratio (IR). The primary focus is on minimizing the SD, as the objective is to minimize risk in a minimum variance portfolio framework.

The empirical results indicate that the GARCH-LSTM-DCC model, particularly with GARCH inputs and one-hot encoding, outperforms the traditional DCC model and the equally weighted portfolio in terms of annualized standard deviation. This suggests that the hybrid approach can effectively improve the accuracy of covariance matrix forecasts and lead to better portfolio risk management.

Key Findings and Contributions

The paper makes several notable contributions to the literature on covariance matrix forecasting:

- Introduction of the GARCH-LSTM-DCC Model: The paper proposes a novel hybrid model that combines the strengths of GARCH models and LSTM networks for improved covariance matrix forecasting.

- Demonstration of Performance: The empirical results demonstrate that the GARCH-LSTM-DCC model can outperform traditional multivariate GARCH models in a minimum variance portfolio framework.

- Insight into Input Features: The paper highlights the importance of incorporating GARCH parameters and one-hot encoding as inputs to the LSTM network for enhanced performance.

Implications and Future Research

The findings of this paper have significant implications for both academics and practitioners. The GARCH-LSTM-DCC model offers a promising approach to improving the accuracy of covariance matrix forecasts, which is crucial for portfolio optimization, risk management, and other financial applications.

Future research directions could include:

- Exploring different LSTM architectures and hyperparameters to further optimize the performance of the GARCH-LSTM-DCC model.

- Investigating the use of other types of GARCH models and input features to capture different aspects of volatility dynamics.

- Extending the model to incorporate other asset classes and market conditions.

- Evaluating the performance of the model in other portfolio optimization frameworks and risk management applications.

- Applying the GARCH-LSTM-DCC model to other areas of finance, such as option pricing and credit risk modeling.

Conclusion

The paper "Forecasting High-Dimensional Covariance Matrices of Asset Returns with Hybrid GARCH-LSTMs" (2109.01044) presents a valuable contribution to the field of financial econometrics by introducing a novel hybrid model for covariance matrix forecasting. The GARCH-LSTM-DCC model effectively combines the strengths of GARCH models and LSTM networks, leading to improved performance in a minimum variance portfolio framework. The findings of this research have practical implications for portfolio managers and risk professionals seeking to enhance their asset allocation and risk management strategies.