- The paper introduces a mathematical framework for identifying profitable cyclic arbitrage by analyzing token cycles and fee impacts.

- The empirical study using Uniswap V2 data reveals opportunities exceeding 1 ETH per transaction, while highlighting execution challenges.

- The research demonstrates that atomic smart contract strategies minimize losses and improve market efficiency in decentralized trading.

Cyclic Arbitrage in Decentralized Exchanges

The paper "Cyclic Arbitrage in Decentralized Exchanges" provides a comprehensive examination of cyclic arbitrage opportunities within decentralized exchanges (DEXes), using Uniswap V2 as a case study. The research focuses on the systematic study of both theoretical and practical aspects of cyclic arbitrage, providing a theoretical framework, analyzing market data, and evaluating trader behaviors.

Theoretical Framework of Cyclic Arbitrage

The paper introduces a mathematical framework for identifying profitable cyclic arbitrage opportunities in automatic market makers (AMM) such as Uniswap. It details the conditions under which cyclic arbitrage is possible and introduces optimal trading strategies for maximizing profits. The analysis is built on the liquidity pools and their inherent price discrepancies in a cycle of tokens A1,A2,…,An. The research reveals that such opportunities exist when the product of the exchange rates throughout the cycle exceeds the losses incurred from transaction fees.

Empirical Evaluation and Market Size

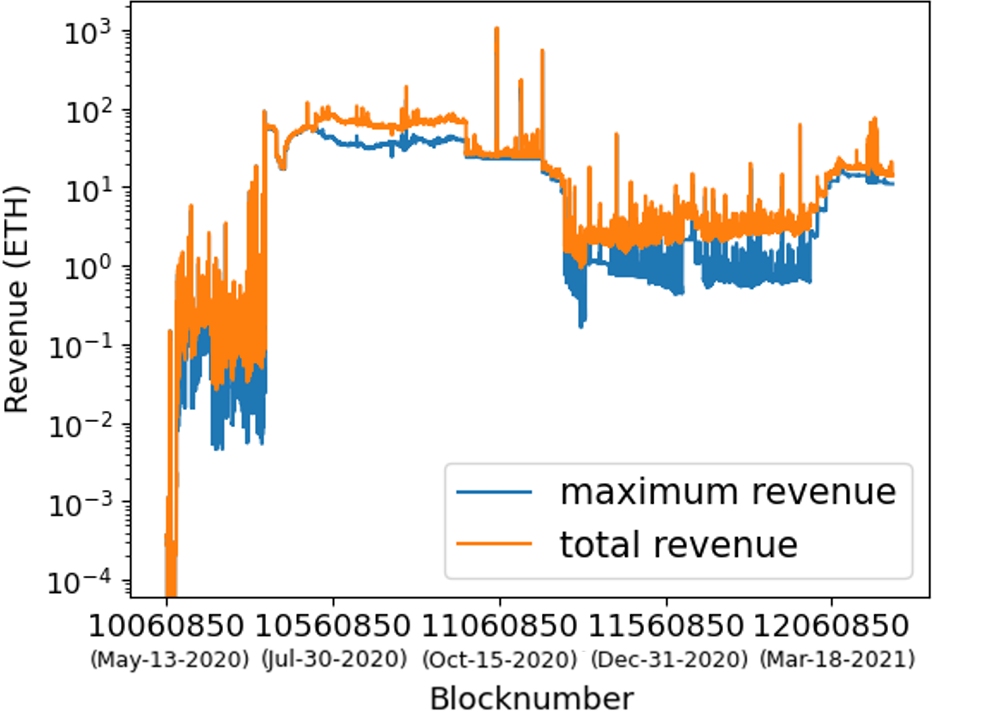

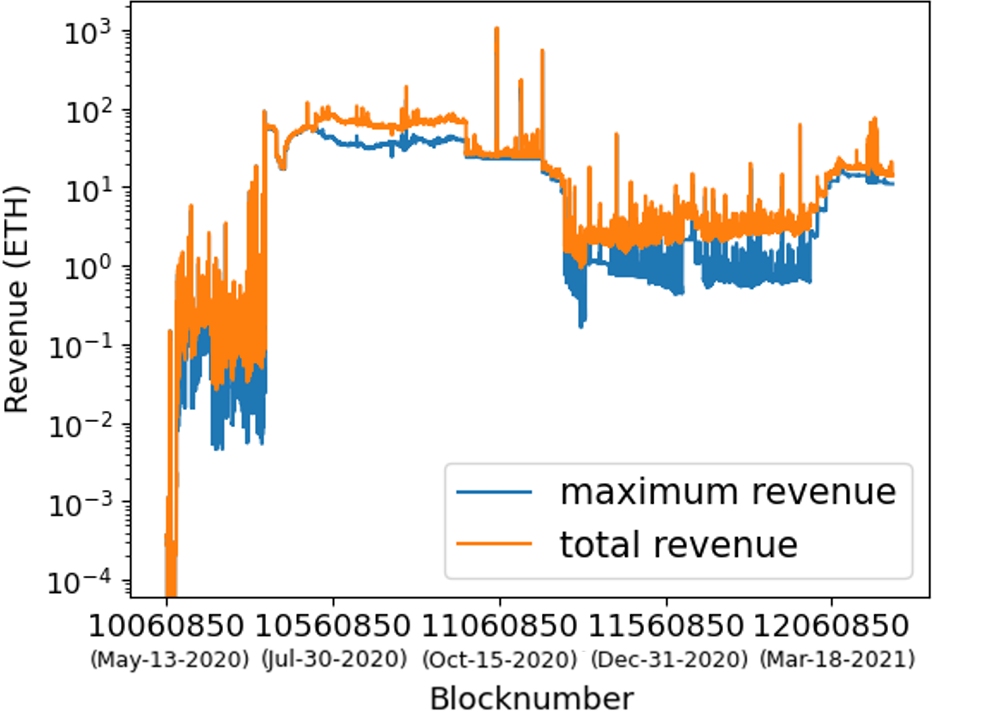

The authors utilized historical transaction data from Uniswap V2 to quantify exploitable and exploited cyclic arbitrage opportunities over a one-year period. They found substantial arbitrage potential, with the maximum revenue of a single opportunity often exceeding 1 ETH (equivalent to $4,000 USD at the time of writing). Despite its inefficiencies, the DEX market size for cyclic arbitrage is noted to be significantly larger than that of centralized exchanges (CEXes).

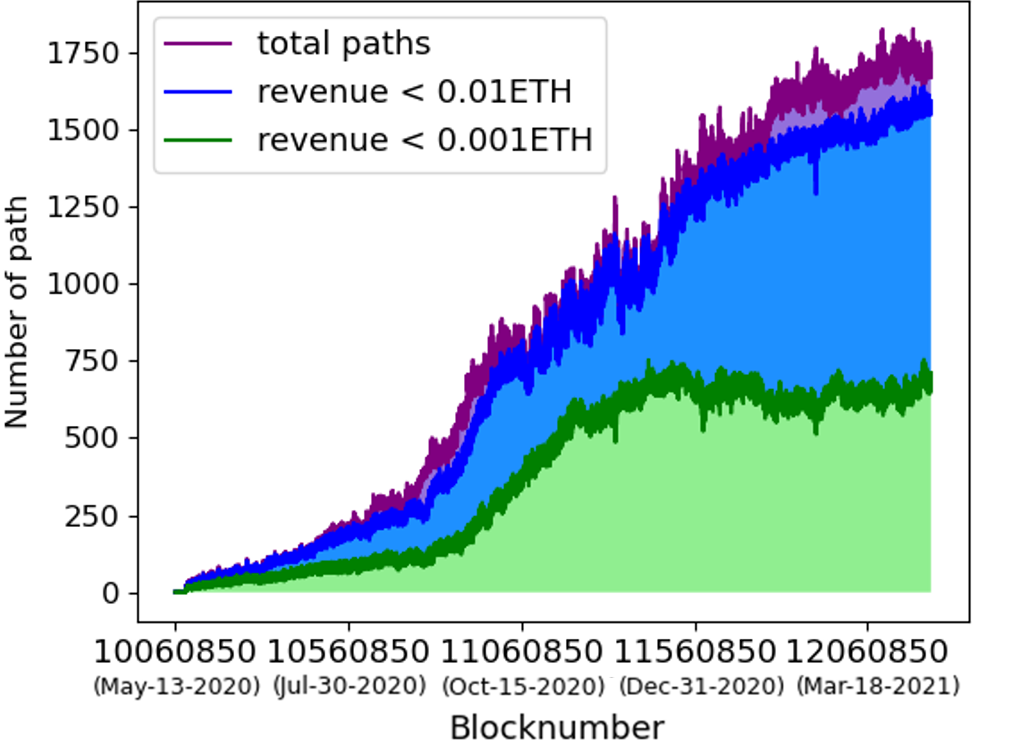

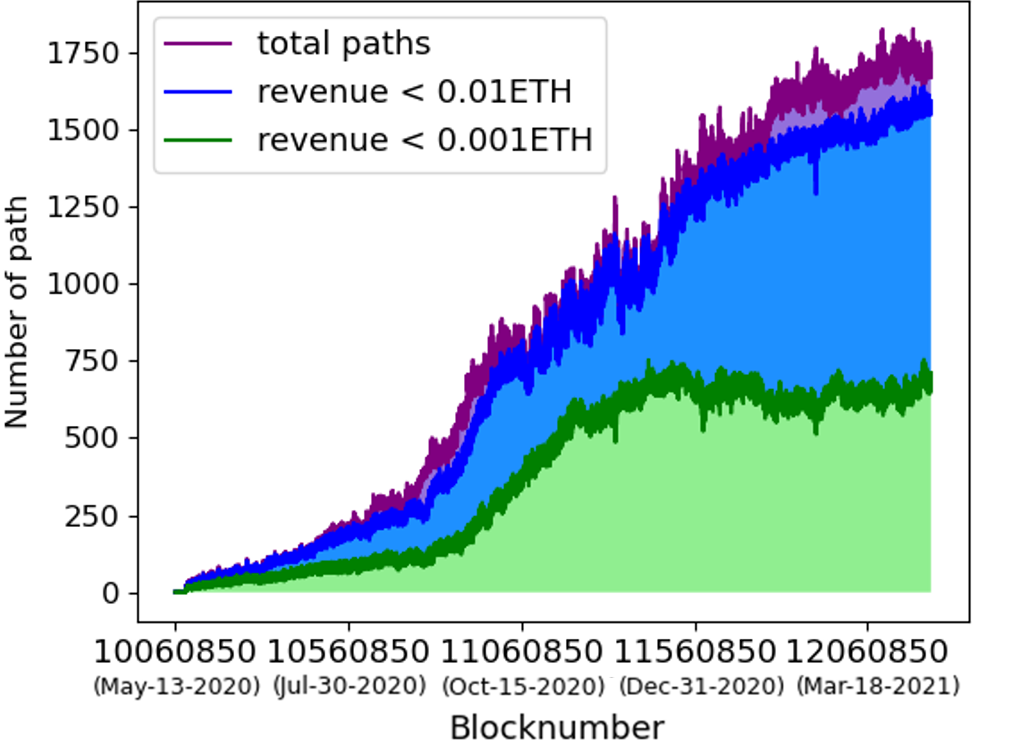

Figure 1: Number of exploitable opportunities in Uniswap V2 over time. The purple line represents cycles with revenue exceeding 0.0001 ETH.

However, the paper outlines that market participants do not exploit all available opportunities, as indicated by the persistent revenue potential across the examined blocks.

Figure 2: Exploitable revenue of cyclic arbitrage per block. The blue line represents the maximum revenue of a single opportunity.

Arbitrage Execution and Market Efficiency

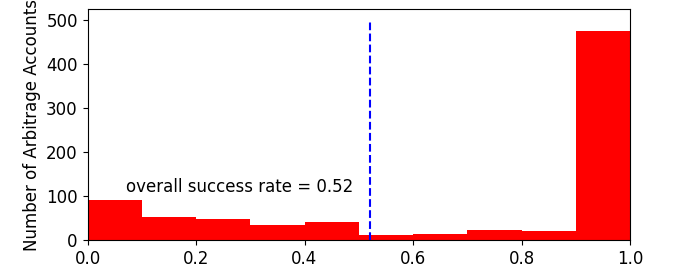

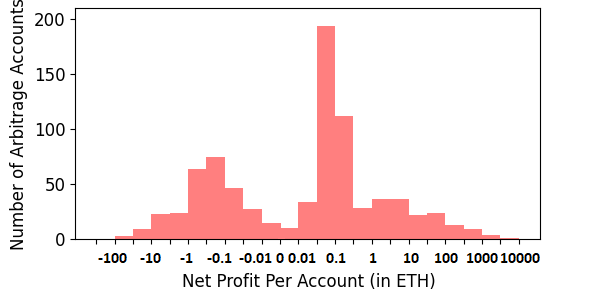

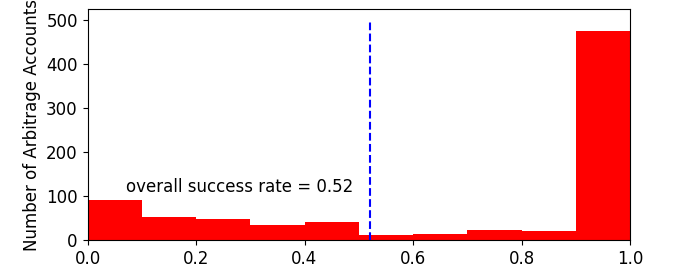

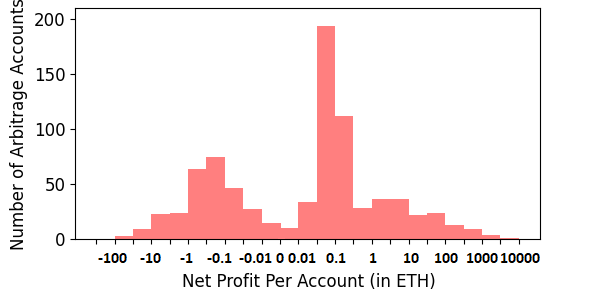

An analysis of 292,606 cyclic transactions revealed that traders predominantly utilize smart contracts to execute atomic transactions. This strategy minimizes financial loss and maximizes the chances of successful execution by reducing the impact of price slippage and front-running attacks by competitors. The effectiveness of atomic implementation is underscored by its prevalence over sequential transaction methods, which are largely inefficient and loss-prone.

Implementation Challenges and Considerations

The study brings to light the importance of transaction fees (gas costs) which account for a significant proportion of the total potential revenue for cyclic arbitrage strategies. Despite high potential revenues, high gas fees and the evolution of market conditions often limit the practical realization of these opportunities.

Figure 3: Lower bound of success rate of traders. The dotted line shows the overall success rate.

Conclusions and Implications

Cyclic arbitrage in DEXes represents an emerging field with significant interest due to its efficiency and higher revenue potentials compared to arbitrage opportunities in CEXes. The research highlights the potential for blockchain technologies, particularly smart contracts, to transform trading strategies and mitigate risks within financial markets.

The paper concludes by suggesting further research on managerial strategies under varying conditions, such as network congestion and fluctuating gas fees, as well as studying the long-term impact of cyclic arbitrages on the market behaviors of other participants within decentralized ecosystems.

Figure 4: Lower bound of net profit of traders.

By systematically scrutinizing the dynamics and effectiveness of cyclic arbitrage in DEXs like Uniswap V2, the authors lay groundwork for understanding, refining, and potentially standardizing these transactions to improve blockchain market efficiencies. Future research is anticipated to explore the practical implications of these findings on the broader blockchain financial ecosystem.